Bizum - Spain's Instant Payment System

Bizum: Revolutionizing Mobile Payments in Spain

Bizum is a Spanish mobile payment platform that has revolutionised the way individuals and businesses handle transactions. Launched in 2016, Bizum is integrated with the banking apps of participating financial institutions, offering a convenient and widely-used service for peer-to-peer (P2P) payments and business transactions. It facilitates quick and easy money transfers, making it an essential tool for splitting bills, paying for services, and online shopping.

Ownership and Management

Bizum is owned by a consortium of Spanish banks. Major financial institutions such as Banco Santander, BBVA, and CaixaBank collaborated to create this service. The platform is managed by Sociedad de Procedimientos de Pago, S.L., which oversees its operations and ensures it meets the standards of security and efficiency expected by its users.

How Bizum Works

Bizum operates by integrating with the mobile banking apps of participating banks. The process to start using Bizum is straightforward:

- Registration: Users register for Bizum through their bank's mobile app by linking their phone number to their bank account.

- Sending Money: To send money, users select the recipient from their phone contacts, enter the amount, and confirm the transaction. The recipient receives the funds instantly in their bank account.

- Receiving Money: Users are notified via SMS or app notification when they receive money, which is automatically credited to their bank account.

- Online Purchases: Bizum can also be used for online shopping by selecting it as a payment option on e-commerce websites that support it.

Key Features and Uses

Bizum’s primary strength lies in its ability to facilitate instant, secure transactions. Here are some of its key features and uses:

- Instant Transfers: Transfers are completed in seconds, making it ideal for quick payments and immediate fund transfers.

- Wide Acceptance: Currently, 36,000 Spanish businesses, including well-known names like Alsa, Renfe, Air Europa, and Decathlon, accept Bizum.

- Online Donations: Bizum allows users to donate to various NGOs such as Doctors Without Borders, the Red Cross, and Amnesty International. These donations are commission-free, ensuring that the full amount goes to the intended organisation.

- Voice Payments: Users can make payments using their voice via Siri, adding an extra layer of convenience.

- Minor Accounts: Bizum is available for users aged 12 to 17 through a special app designed for minors. Parents can monitor and control their children's transactions.

Limitations

Despite its many advantages, Bizum has several limitations:

- Geographical Restriction: It is primarily available to users with bank accounts in Spain.

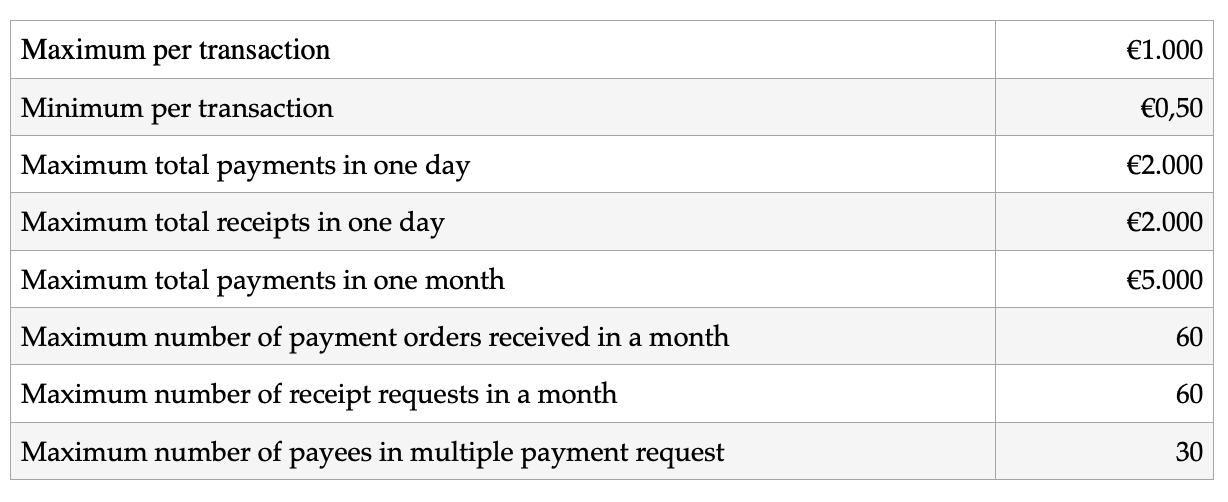

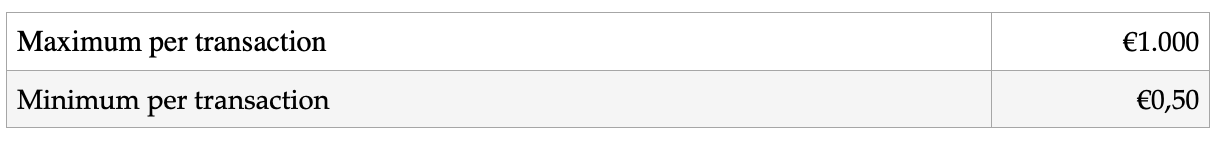

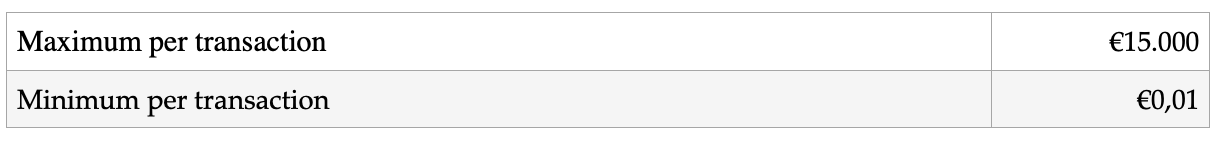

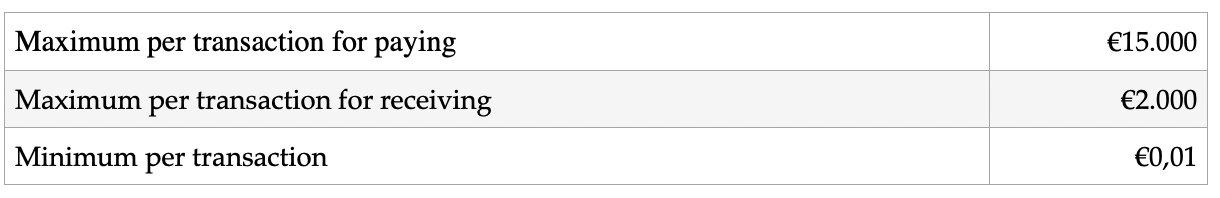

- Transaction Limits: Daily and monthly transaction limits vary from bank to bank, but the following are typical:

Payments Between Individuals

Payments Between The Payer And NGOs

Payments Between The Payer For Electronic Purchases

Payments Between The Payer And Any Official Public Body

- Bank Dependency: Both the sender and receiver must have bank accounts with participating banks.

- Limited International Use: Bizum is mainly for domestic transactions, with limited functionality for international transfers.

- Multiple Accounts: Users cannot link several bank accounts to the same mobile number, although multiple mobile numbers can be linked to the same bank account.

User Base and Transaction Volume

As of 2024, Bizum boasts over 25 million users, (in a population of 48 million) making it one of, if not the, most widely adopted payment methods in Spain. The average transaction amount is approximately €50-60, with variations depending on the nature of the transaction. Despite the limitations on geographical usage and transaction limits, Bizum has become a cornerstone of mobile payments in Spain, backed by all the major traditional banks and even some of the online banks such as Revolut It is now widely used for personal and business transactions.

Spain is a trailblazer in the adoption of instant credit transfers and a leader in Europe. So much so that instant credit transfers account for 53% of all transfers processed in Spain compared with the European average of around 15%.