What Is The Catastro In Spain?

Many clients ask us about the Catastro. They've heard of it in connection with property purchases, but don't know what it does and why it is important. I'll attempt to explain with some concrete examples:

Property Identification

The origins of the Catastro date back to the 18thC. The introduction of land use planning was a threat to the privileged classes because once ownership was attributed to each plot of land, the owner could no longer claim not to own it, nor to own less land than, in reality, in order to avoid taxes. The primary function of the Catastro is to identify all real estate properties in Spain. This includes both urban, rural, and industrial properties. Each property is assigned a unique catastral reference, which ensures clear identification and helps prevent disputes over ownership.

Property Valuation

The Catastro is responsible for assessing the value of properties. This valuation is crucial for various purposes, including taxation, buying and selling properties, and other legal matters. From time to time, the Catastro conducts updates to reflect changes in property values, in an attempt to ensure that taxes are fair and accurate.

Data Management and Accessibility

Maintaining an extensive database of property-related information, the Catastro provides valuable data to the public and various government entities. This data includes property boundaries, physical characteristics, ownership details, and valuation information. Much of the data, such as boundaries, size of buildings, measurement of land, etc. is accessible online, offering a user-friendly interface for property owners and professionals to retrieve information. However, owner’s names are not available, as this is not public information.

Role in Taxation

One of the Catastro’s most significant roles is in the realm of taxation. The catastral values it determines are used as the basis for property tax calculations. Theoretically, this ensures a transparent and equitable system where property taxes correspond to the notional value of properties. Catastral values have traditionally fallen way short of market values. This has been recognised recently with the introduction of catastral reference values which approximate to commercial values. Currently, only a small percentage of properties have a catastral reference value but, in time, all properties will have one.

Importance of the Catastral Value.

There are three important cases where the catastral value comes into play:

1) Annual Property Tax (IBI)

Every year property owners receive an invoice for the annual property tax which is based on the catastral value of both land and buildings. Each municipality sets the annual percentage based on its budgetary needs. In most municipalities, it is paid in two instalments, for instance, in May and July. Failure to pay on time results in a penalty, often of 10%.

2) Property Purchase - the purchase tax (I.T.P.) when buying a property is calculated as a percentage of the selling price. In Andalucia, currently there is a flat rate of 7%. In other Autonomous Communities it is often higher and there is a staggered rate, increasing in steps as the value of sale increases.

An example: Sale price €300.000. I.T.P. = 7% x €300.000 = €21.000.

However, if the catastral (reference) value x the coefficient for the municipality in which the property is located (they change each year) is greater than €300.000, the local authority will issue a supplemental invoice.

An example: Sale price €300.000. Catastral value €98.500. Coefficient 3.97.

3.97 x €98.500 = €391.045 - €300.000 (on which tax has already been paid) = €91.045.

€91.045 x 7% = €6.373.15, the sum which the local authority will invoice the (unsuspecting) buyer shortly after she has moved in.

If this calculation results in a figure lower than the tax calculated on the true price, there is no reduction in the amount payable.

3) Plusvalia - a municipal tax on the sale of properties based on the notional increase in value of the land during the period of ownership. Broadly speaking, the longer a property has been owned, the higher the plusvalia will be. The tax is based on the catastral value of urban (not rural) land. Each municipality establishes a (notional) percentage increase in the value of land for each year of ownership. The calculation runs from the date of purchase (inheritance, donation) to the date of sale.

Urban Planning and Development

The data managed by the Catastro is indispensable for urban planning and development. Municipalities rely on this information to make decisions about land use, zoning, infrastructure development, and environmental management. Boundaries between urban and rural areas are controlled in this way, enabling control of e.g. building extensions on non-urban land. Accurate catastral data helps in designing sustainable urban growth strategies and ensuring efficient land use, as not merely buildings but changes in agriculture are indicated on the catastral plans. This is important, for instance, in the management of agricultural subsidies.

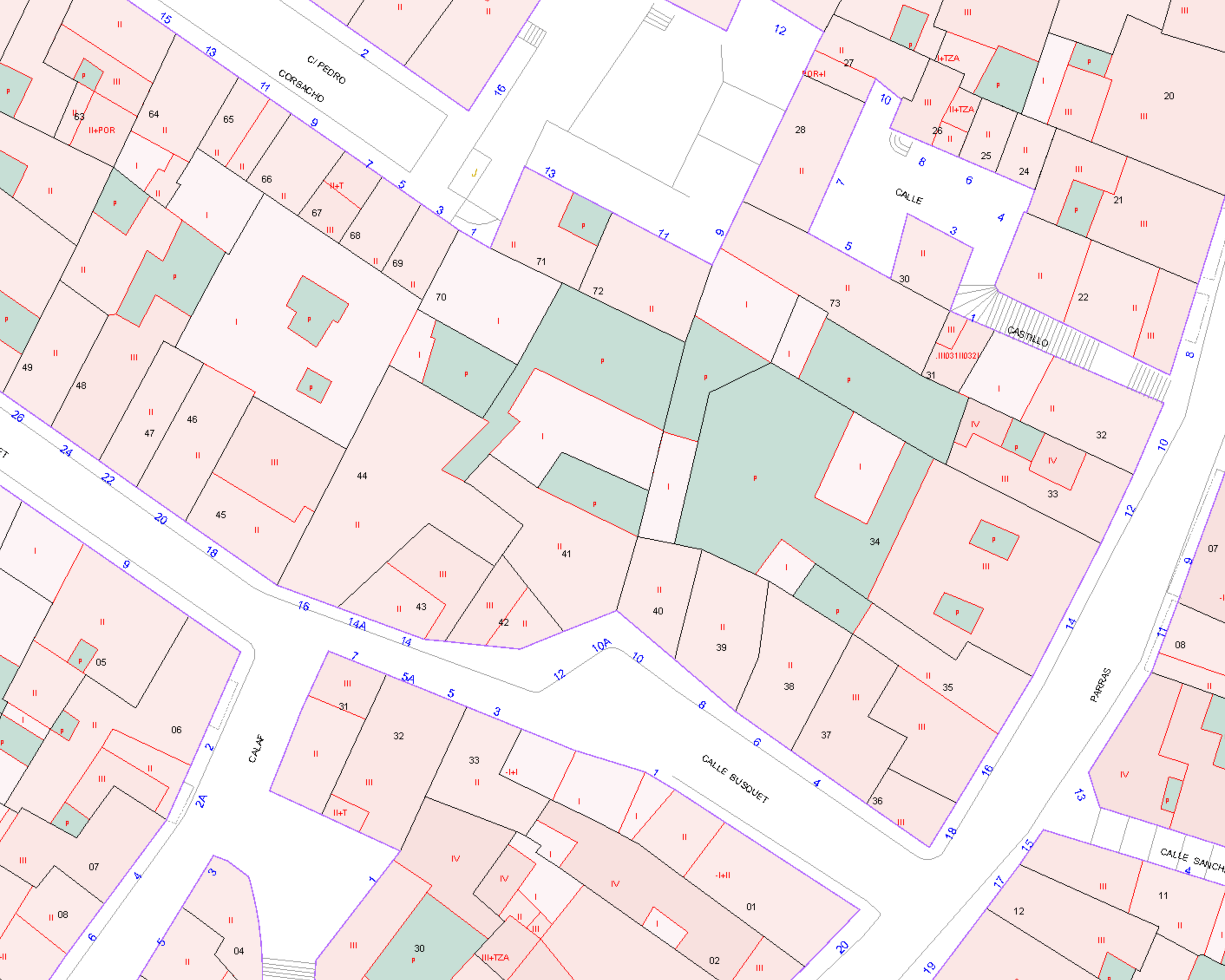

Catastral Plan: Example Of An Urban Area

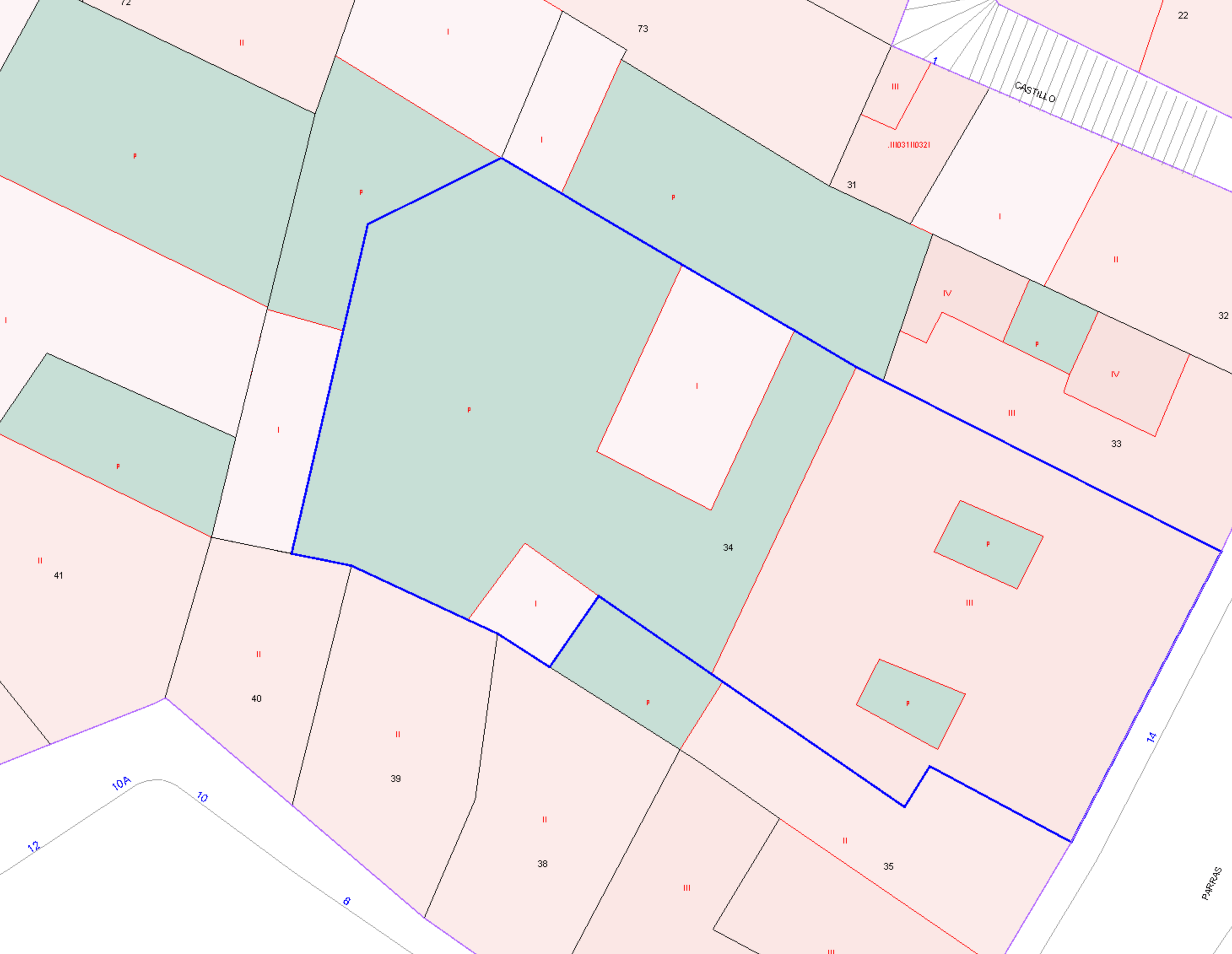

The Catastral Boundaries For An Individual Property

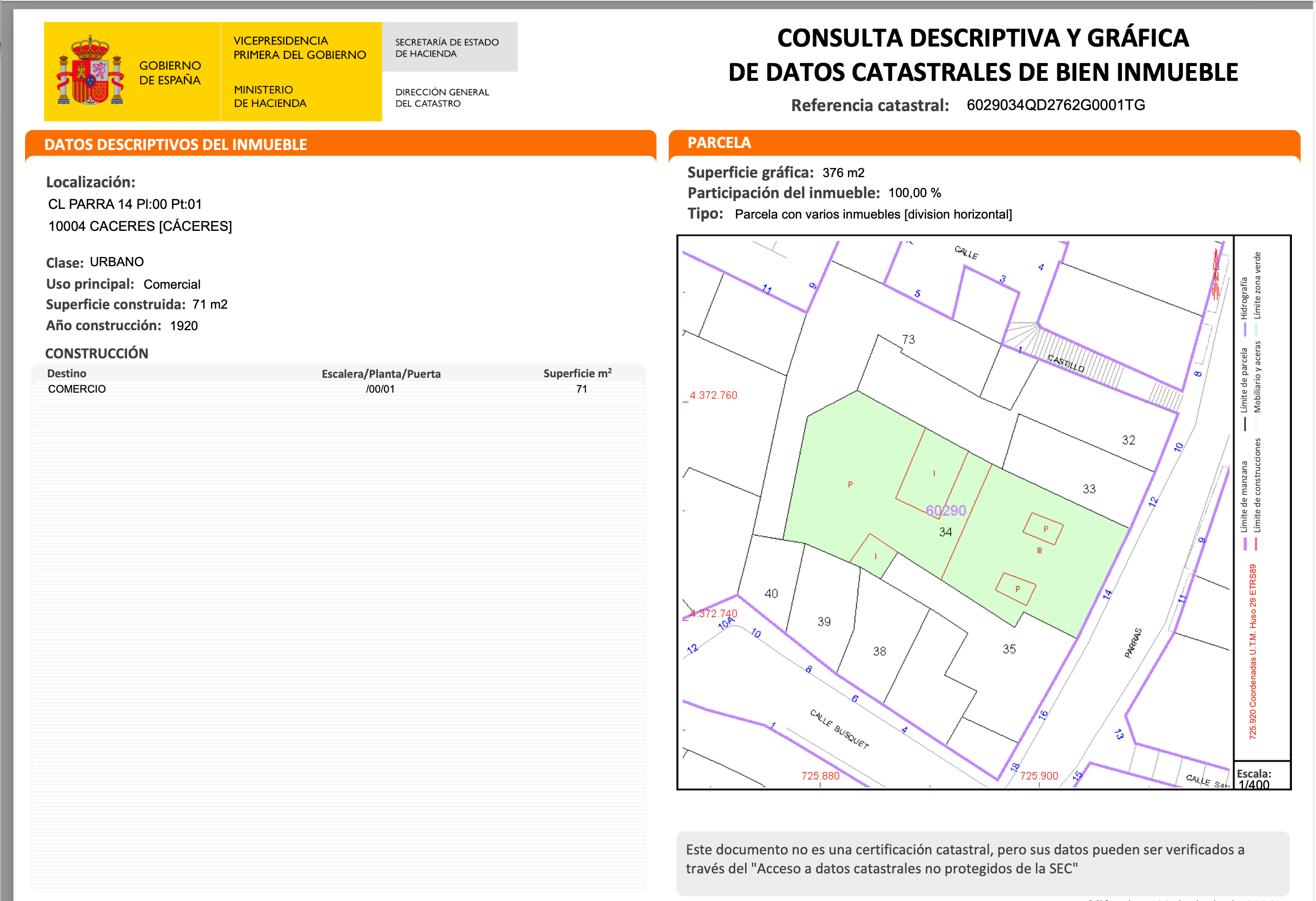

A Detailed Catastral Consultation For The Same Property

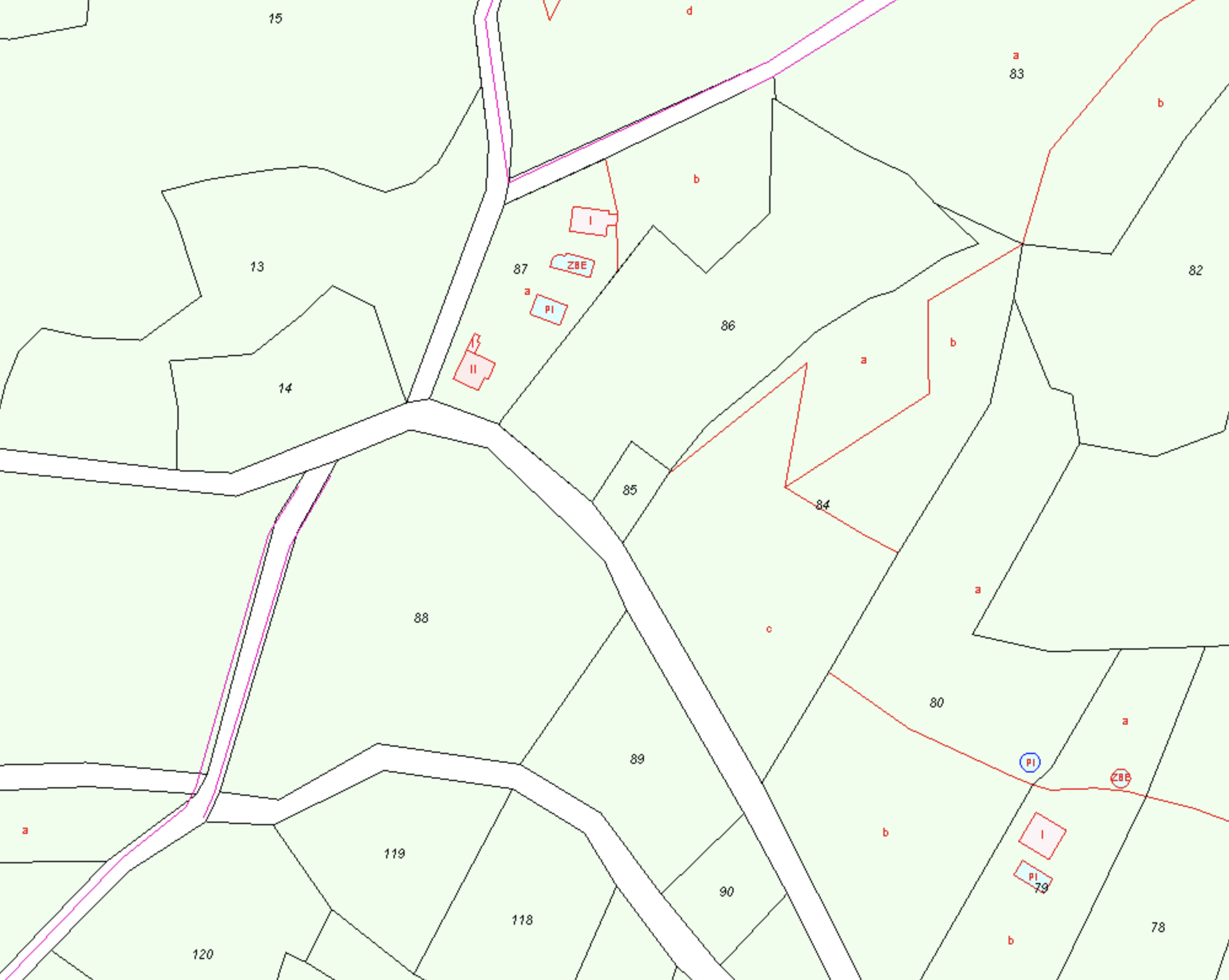

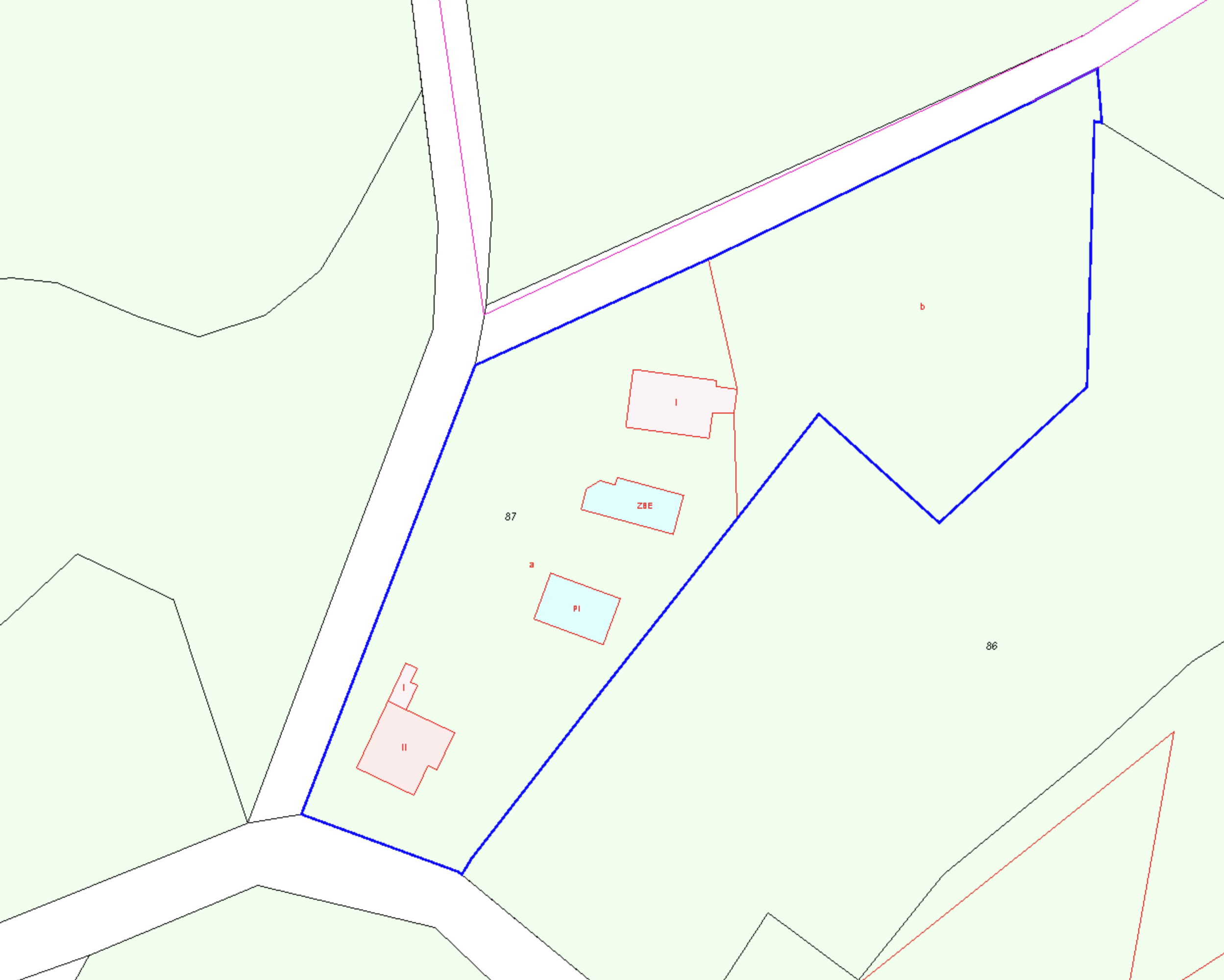

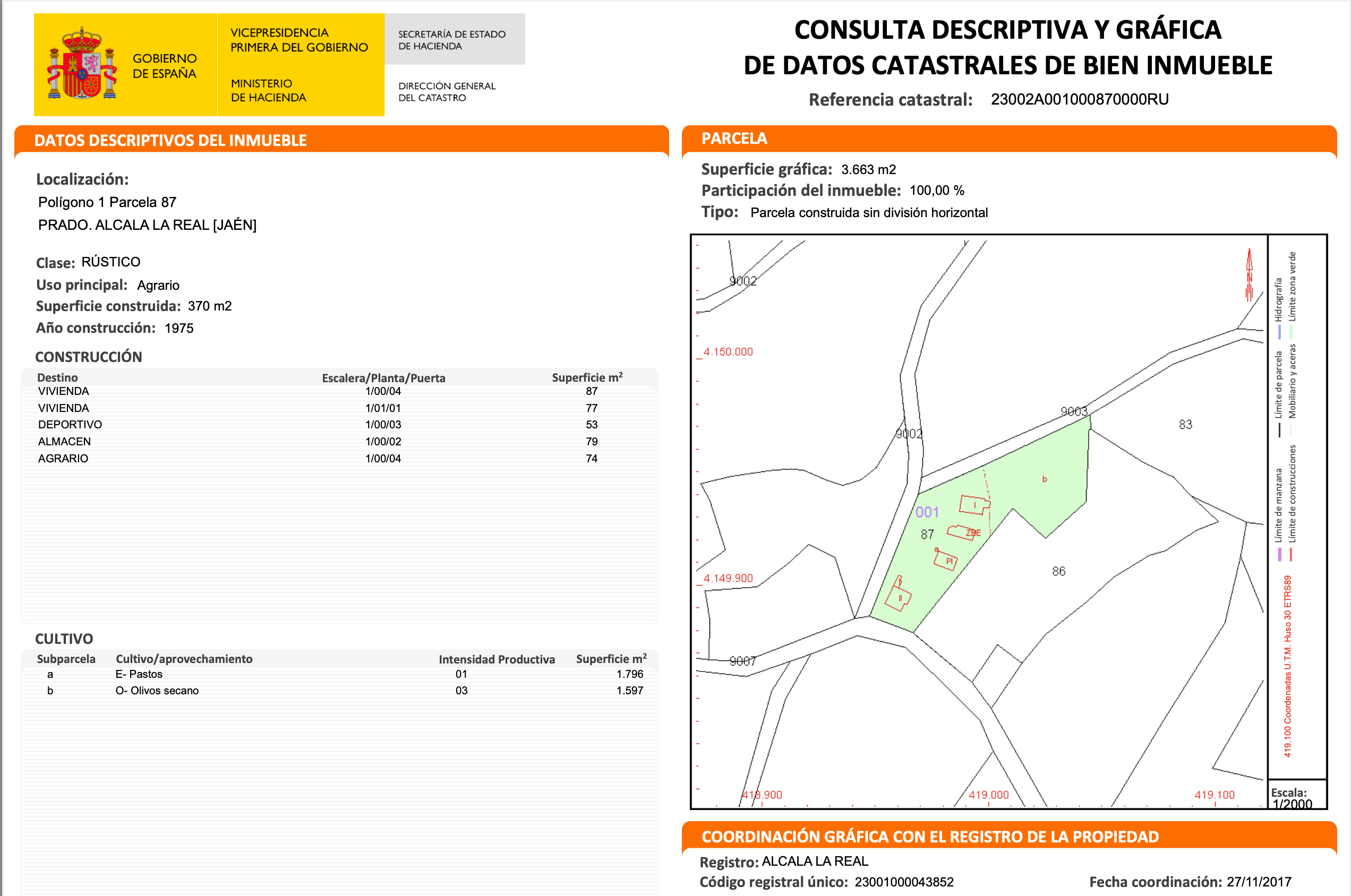

In rural areas the catastral plan might look quite different:

The Catastral Boundaries For An Individual Property

A Detailed Catastral Consultation For The Same Property

Is The Catastro A Catastrophie?

We often say this, only half in jest. Catastral boundaries are not always correct. Sometimes non-existent tracks appear across private land. However, in recent years, the Catastro has embraced technological advancements to enhance its operations. Geographic Information Systems (GIS), remote sensing, and digital databases have revolutionized the way property information is recorded and accessed. These technologies have improved accuracy, reduced processing times, and increased transparency. Each time a document is submitted to the Catastro for any change, it must now be accompanied by georeference points which accurately record the boundaries. In one or two lifetimes, with luck, the Catastro may achieve French style accuracy. Until then, those of us who work in Spanish real estate, especially in rural areas, have to deal with the three elements which should all reflect exactly the same story (but rarely do): Reality, the Registry and the Catastro.

Part of our work is to recognise these differences and to work with relevant agencies to get inaccuracies rectified and get the three elements to agree, if not perfectly, as close as possible.